With interest rate hikes and adjustments to balance sheet policies making for an increasingly contractionary stance of monetary policy, it is important to assess how these might affect the Australian economy. However, a broader range of factors determine the degree to which developments in the financial sector influence the real economy beyond just changes in monetary policy. The concept of ‘financial conditions’ can be used to describe this broader picture.

This note defines financial conditions, describes why they are important to consider, estimates a Financial Conditions Index for Australia to measure these and discusses what current financial conditions imply for the economic outlook.

What are financial conditions?

Financial conditions describe how the state of the financial sector impacts the real economy. The term is used commonly by central banks, including the US Federal Reserve, European Central Bank and RBA.

Measures of financial conditions have evolved over time. Early analysis focused on monetary policy and its impact on the cost of capital. However, monetary policy impacts economic conditions in a variety of ways beyond just changes in interest rates. To account for this, the Bank of Canada developed a Monetary Conditions Index which captured movements in both interest rates and exchange rates. Some central banks such as the Reserve Bank of New Zealand were keen adopters of this at the time while others, such as the RBA, were not.

Over time researchers started to include more channels through which changes in financial sector conditions impacted the real economy (Table 1). This was especially apparent following the GFC.

Table 1 – Channels through which financial variables influence economic activity

| Variable | Channel |

| Cost of capital | Affects the ability of borrowers to obtain new and service existing loans. This could impact spending by households and capital investment by business. |

| Availability of capital | How willing lenders are to extend credit can influence how much businesses can borrow to expand production capacity and how much households can borrow to build houses or purchase durable goods. |

| Asset prices | Changes in asset prices can affect households’ willingness to spend and ability to borrow, while at the same time, can encourage risk taking. These can also alter business’ ability to raise capital. |

| Financial market stresses | Large movements in key variables, like interest rates and asset prices, can create uncertainty which can affect firms’ ability to access capital and the cost of doing so. |

| Exchange rate | Can influence the competitiveness of exporters under certain circumstances. |

Source: Various studies, QTC Economic Research

The different ways through which the financial sector can impact the economy means it is important to be able to measure shifts in these ‘financial conditions’. The next section aims to do this by estimating a Financial Conditions Index (FCI) for Australia.

An Australian Financial Conditions Index

The Australian FCI summarises movements across a range of different financial variables. Each of the components of the FCI is related to the different channels through which changes in financial sector conditions can flow through to the real economy, including:

- Monetary policy expectations

- Other aspects of the transmission of monetary policy

- The (relative) cost of credit

- The availability of credit

- Financial market stress

Further details on how the index and its components were estimated are contained in the Technical Appendix.

How have financial conditions evolved in Australia?

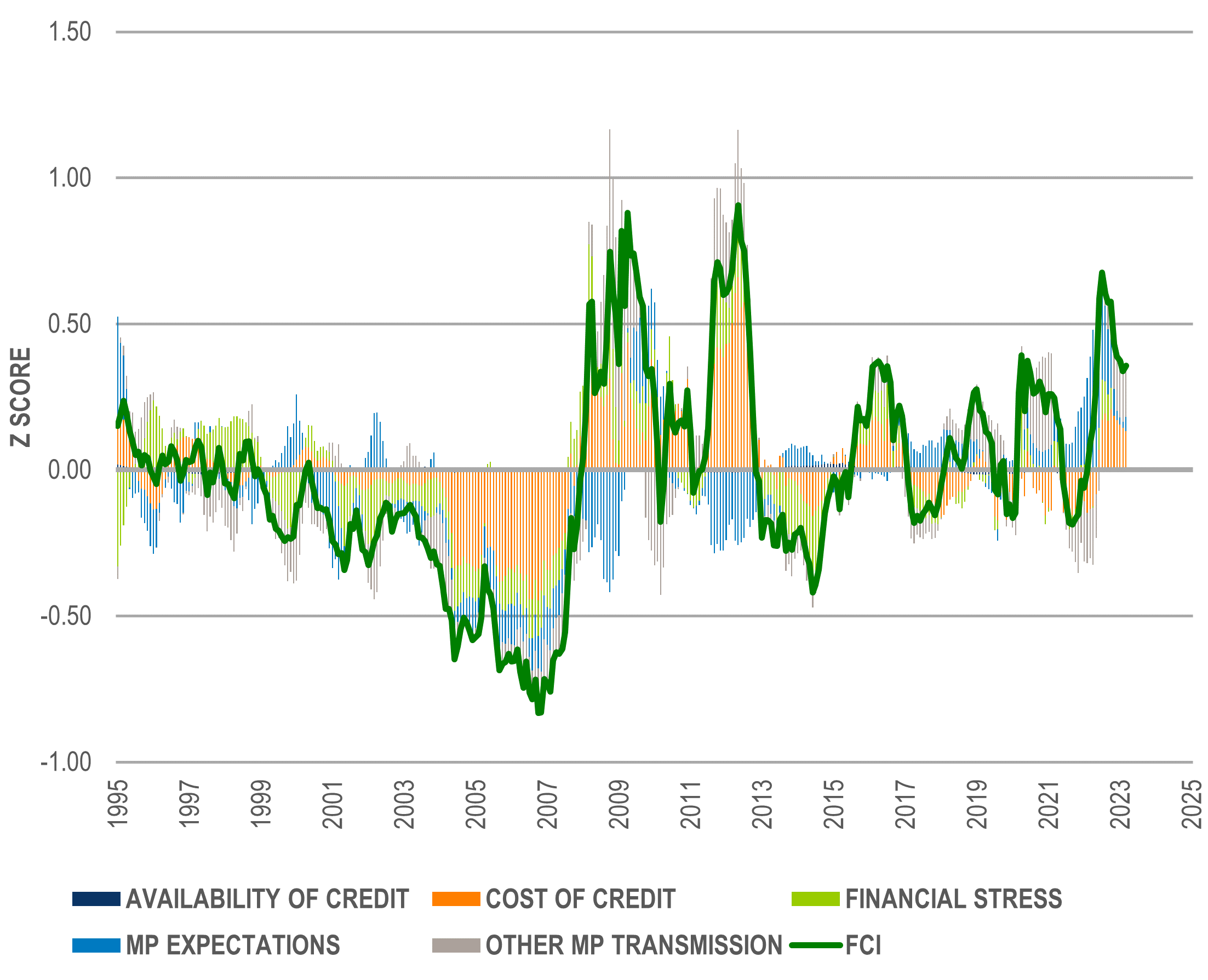

The estimated FCI is consistent with broad developments in recent decades. For example, financial conditions were relatively loose in the period prior to the GFC but tightened significantly when the crisis took hold. Similarly, conditions responded as expected during periods such as the European Sovereign Debt Crisis, the capital outflow episode for China in 2015 and 2016, the ramp up of US-China trade tensions in 2018 and COVID‑19 (Graph 1). Most recently, financial conditions tightened significantly between September 2021 and mid‑2022. Apart from the availability of credit, all other components of the FCI contributed to this change, with around 70 per cent of it due to variation in the cost of credit and monetary policy expectations. This tightening has since partially unwound as the market has reduced expectations of further interest rate increases. Note, these estimates were prepared prior to the emergence of concerns about some global banks in March 2023.

Graph 1: Financial conditions index

Note: Graph 1 shows by how many standard deviations financial conditions deviate from their average level. Being above (below) zero indicates that conditions are tighter (looser) than average.

Source: QTC Economic Research

What do current financial conditions imply for the economic outlook?

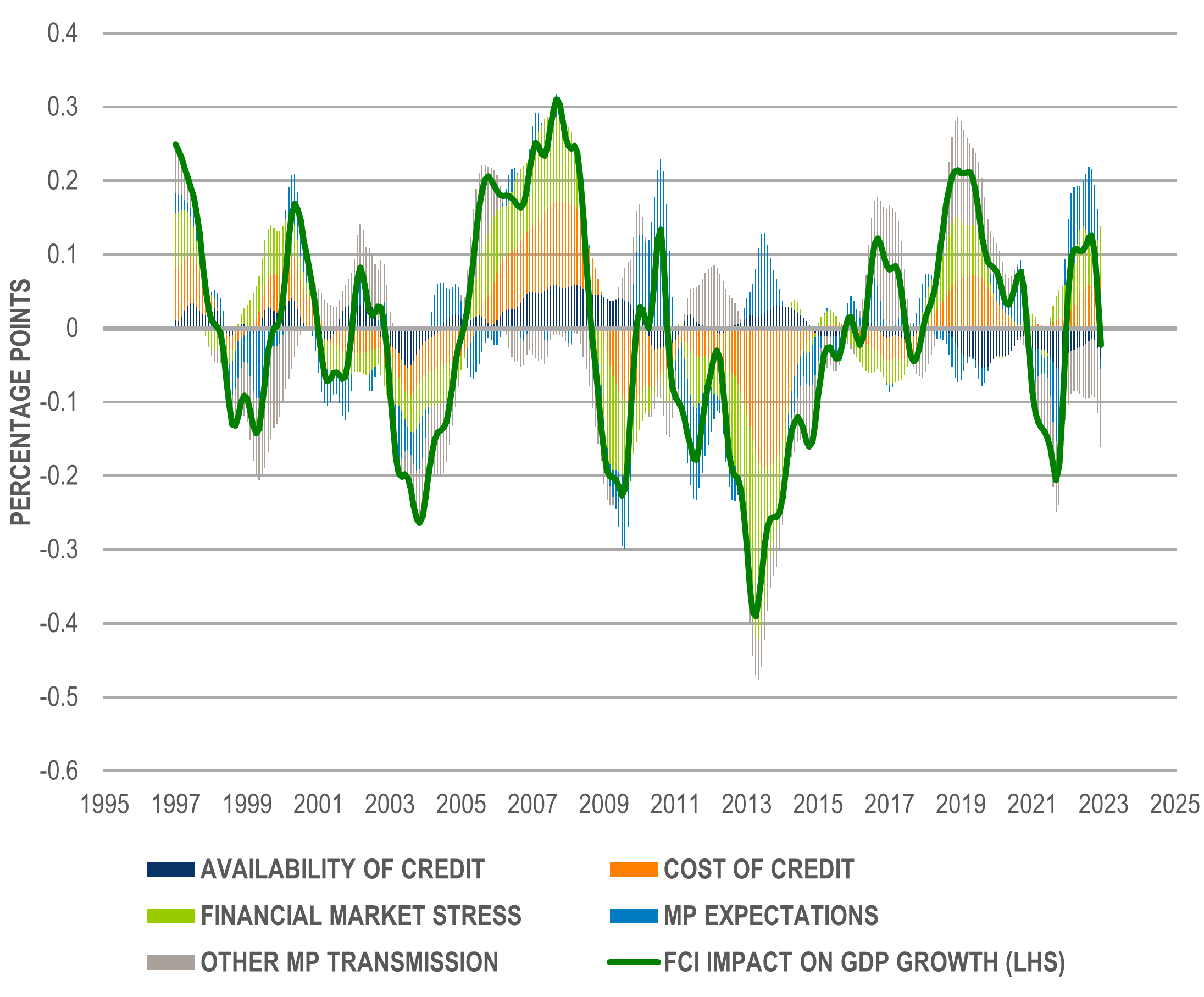

Central banks have increasingly referred to measures of financial conditions over time, a development which reflects the rising awareness of the many ways in which financial sector developments can, with a lag, impact the real economy. Graph 2 breaks down how the different components of financial conditions are estimated to have impacted GDP growth in Australia. It highlights how loose financial conditions have supported Australian economic growth at different points of time such as in the period of low economic and market volatility prior to the GFC. Conversely, it is also clear how tight financial conditions, such as during the European Sovereign Debt Crisis, have ultimately been a drag on GDP growth.

Graph 2: Impact of financial conditions on GDP growth

Note: Graph 2 shows the impact on quarterly GDP growth of changes in the different components of financial conditions on average over the previous 12 months (with this then smoothed via a three‑month moving average).

Source: QTC Economic Research

In recent times, COVID-19 saw a significant tightening of financial conditions. Over the year, from March 2020 the 12‑month average impact of financial conditions on quarterly economic growth saw a -0.4 percentage point turnaround. Over the year that followed this more than fully unwound as the policy response induced easing in financial conditions saw a boost to GDP growth. Since that impact topped out around a year ago, the tightening of financial conditions, led by that directly related to monetary policy, has weighed on GDP growth again and for the last six months has been a drag on growth.

Implications

After increasing interest rates to 3.60 per cent at its March 2023 meeting, the RBA noted how tighter financial conditions have weighed on household spending (the largest component of GDP). This is consistent with financial conditions now presenting a modest headwind to GDP growth. However, ahead of the concerns which emerged this month about some overseas banks, financial conditions had eased in Australia recently. This is the opposite of what is required to exert a restraining influence over economic activity and inflation. With the stance of monetary policy being only mildly contractionary further interest rates rises, as well as a tightening of the other drivers of broader financial conditions, will be needed for the RBA to bring inflation back to target.