2013-14 Annual Report (Text version)

The Queensland Treasury Corporation Annual Report 2013-14 provides details of Queensland Treasury Corporation’s (QTC’s) achievements, outlook, performance and financial position for the 2013-14 financial year.

Vision

Securing Queensland’s financial success

Mission

To deliver optimal financial outcomes through sound funding and financial risk management

Values

We are focused on our clients

We are passionate about Queensland

We value and respect our people

We are collaborative and seek continuous improvement

Above all else, we value integrity

As the Queensland Government’s central financing authority, Queensland Treasury Corporation (QTC) plays a pivotal role in securing the State’s financial success.

With a focus on whole-of-State outcomes, QTC provides a range of financial services to the State and its public sector entities, including local governments. These services include debt funding and management, cash management facilities, financial risk management advisory services, and specialist public finance education.

Debt funding and management

QTC borrows funds in the domestic and global markets in the most cost-effective manner and in a way that minimises liquidity risk and refinancing risk. QTC achieves significant economies of scale and scope by issuing, managing and administering the State’s debt funding.

QTC works closely with Queensland’s public sector entities, including local governments, to assist them to effectively manage their financial transactions, minimise their financial risk and achieve the best financial solutions for their organisation and the State.

Cash management facilities

QTC assists the State’s public sector entities to make the best use of their surplus cash balances within a conservative risk management framework. It offers overnight and fixed-term facilities and a managed short-term fund.

Financial risk management advisory services

QTC offers a range of financial risk management advisory services to clients, including:

- support to ensure financial risks are identified and effectively managed

- advice on financial and commercial considerations

- expertise in financial transactions and structures

- project management support to deliver key fiscal outcomes, and

- collaboration with the financial markets and private sector institutions.

Specialist public finance education

QTC offers a range of education and training courses that complements its products and advisory services and allows it to share its specialist financial, commercial, treasury management and risk management expertise with clients. Courses are developed and delivered by QTC’s experienced professionals and industry experts.

23 September 2014

The Honourable Tim Nicholls MP

Treasurer and Minister for Trade

GPO Box 611

Brisbane Qld 4001

Dear Treasurer

I am pleased to present the Annual Report 2013-14 and financial statements for Queensland Treasury Corporation.

I certify that this Annual Report complies with:

- the prescribed requirements of the Financial Accountability Act 2009 and the Financial and Performance Management Standard 2009, and

- the requirements set out in the Annual Report requirements for Queensland Government agencies.

A checklist outlining the annual reporting requirements will be available on our website immediately following the tabling of this report in Parliament.

Sincerely

Gerard Bradley

Chairman

- Raised $11.1 billion to meet the State’s funding requirements, issuing two new benchmark-sized floating rate notes to complement existing fixed rate benchmark bonds

- Declared a dividend of $120 million to Government

- Generated savings for the State and clients of $152 million through portfolio management, funding strategy execution and debt management advice

- Managed QTC’s Capital Guaranteed Cash Fund, which outperformed its benchmark, the UBS Australian Bank Bill Index, by 0.80 percentage points, and was ranked first in the CPG Research & Advisory Pty Ltd performance report

- Completed 122 significant advisory assignments for clients, helping them meet their individual objectives in relation to the Government’s reform agenda, as well as improve their business-as-usual outcomes

- Trained more than 700 employees from 50 public sector organisations through QTC’s targeted and tailored education program

- Maintained a mature, strong and well-understood risk management culture and firmly established enterprise-wide risk management program as the foundations for all corporate activities

- Appointed to conduct the pre-work and preliminary due diligence activities for the Government’s proposed assets transactions initiative

- Seconded specialist staff to the Government’s Projects Queensland office to deliver key infrastructure for the State

- Continued the implementation of an integrated suite of HR programs to enhance the agility, capability, capacity and engagement of QTC’s workforce

QTC’s Five-year business summary (PDF). (Download pdf, 163.70 Kb)

As conditions settled in the global financial markets, lowering uncertainty and volatility to post-crisis lows, and the Queensland Government continued the implementation of its primary fiscal objectives, Queensland Treasury Corporation (QTC) successfully funded the State’s borrowing program, contributed to many of the State’s priority projects, and provided significant whole-of-State benefits.

Funding objectives met

Buoyed by lower levels of volatility in the financial markets and the State’s progress towards fiscal reform, 2013-14 saw QTC bond spreads compress to pre-financial crisis levels for short- and mid-curve bonds, with a number of new investors attracted to QTC bonds.

QTC raised $11.1 billion to fund its borrowing program with the launch of a new 2025 benchmark bond in April 2014, and two benchmark-sized floating rate notes with maturities in 2016 and 2017, and driven by investor demand. This was supplemented with short-term issuance, which was maintained with an average of $5 billion on issue throughout the year.

On the cash management side, QTC’s Capital Guaranteed Cash Fund outperformed its benchmark, the UBS Bank Bill Index, by 0.80 percentage points and was ranked first in the CPG Research & Advisory Pty Ltd performance report, providing QTC’s clients with strong returns.

QTC’s long-standing commitment to openness and transparency continued, with its investor relationship program delivered in partnership with the domestic and global banks of its Fixed Income Distribution Group to enhance existing market relationships and attract new investors.

Operating result positive

For the 2013-14 year, QTC recorded an operating profit after tax from its capital markets operations of $119.2 million (2012-13: $222.9 million) primarily due to fair value accounting gains associated with the management of QTC’s funding task and balance sheet.

QTC borrows in advance of requirements to ensure public sector entities have ready access to funding when required, to reduce the risk associated with refinancing maturing loans, and for liquidity management purposes. As a consequence of market changes, realised and unrealised accounting gains or losses may be recorded during the year which, depending on whether these transactions are held to maturity, may be reversed in subsequent accounting periods.

Separate from QTC’s capital markets operations, the long-term assets operations recorded a profit of $3,128.0 million (2012-13: $990.3 million). This segment comprises the investments that fund the State’s defined benefit superannuation and other long-term employee obligations.

Managed by QIC, these obligations were transferred to QTC by the Queensland Government under an administrative arrangement in 2008; in return, QTC issued the State with fixed-rate notes that provide a fixed rate of return. While QTC bears the fluctuations in the value and returns on the asset portfolio, there is no cash flow effect for QTC. Any losses incurred by this segment have no impact on QTC’s capital markets activities or its ability to meet its obligations.

Whole-of State contribution prioritised

QTC supported the Government’s central agencies with their implementation of its fiscal reform agenda, with the:

- completion of the first stage of the Government’s proposed asset transactions, which are subject to a mandate from Queensland voters at the 2015 election

- secondment of staff to enable Treasury’s Projects Queensland office to deliver some of the State’s most significant infrastructure projects, and

- enhancement of the financial and risk management capabilities of Government agencies through a range of education and training initiatives.

Client advisory increased

In the year under review, QTC prioritised the delivery of its collaborative, value-adding assignments for the State’s public sector, increasing the breadth of assignments and agencies. Assignments helped deliver cost-effective social housing and public schools; assess EOIs for several major developments; plan for the introduction of the NDIS; and support councils to deliver financially sustainable services to their communities.

The positive outcomes generated by these activities saw a continuing lift in clients’ sentiment towards QTC and perception of its ability to add value through advisory work.

Two Board members farewelled

QTC farewelled two Board members—Neville Ide, whose resignation was effective 1 July 2014, and Gillian Brown, whose resignation was effective 21 August 2014—with best wishes and sincere thanks for their significant contributions to QTC over the years.

Looking ahead

In 2014-15, with its talented and committed staff, QTC will make the most of the global opportunities for bond issuance to cost-effectively fund Queensland’s infrastructure requirements; maintain its operational focus on improving efficiency and ensuring prudent risk management; and continue its partnership with Government to deliver fiscal reform and secure the State’s financial success.

G P Bradley

Chairman

P C Noble

Chief Executive

Corporate Performance Report

In 2013-14, QTC raised $11.1 billion to fund the State’s borrowing program. The borrowing program was reduced by $1 billion following the Government’s mid-year fiscal and economic update in December 2013, as a result of better operating performance in the general government sector, lower borrowing requirements across Government, and the deployment of surplus liquidity.

The majority of term debt funding was raised through public issuance using a variety of methods including syndicated primary transactions, taps and online tenders. For the first time since 2011, QTC issued floating rate notes (two maturities) in response to investor demand.

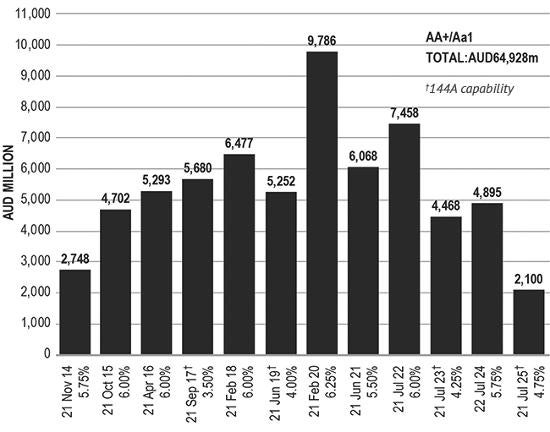

QTC’s Australian dollar benchmark bonds remained the cornerstone of its funding activities and in April, QTC lengthened the profile of its curve by issuing a new benchmark bond line maturing in 2025. This line was issued with 144A capability and, as a result, a number of US-based investors participated in the primary transaction.

In the period under review, QTC delivered a lower borrowing cost for the State, as bond spreads narrowed significantly; contracting, on average over the year, by 0.40 percentage points against Australian Government bonds and 0.30 percentage points to the benchmark swap rate.

In addition to providing its clients with a lower cost of funds, QTC also used its financial markets expertise to reduce transaction costs by further aligning debt issuance with client drawdowns, and to provide quality assurance of the risk analysis and pricing for public private partnerships.

QTC continued to offer a range of products that enabled clients to maximise the value of their surplus funds. This past year, QTC’s Capital Guaranteed Cash Fund outperformed its benchmark, the UBS Australian Bank Bill Index, by 0.80 percentage points and was ranked number one in the CPG Research & Advisory Pty Ltd performance report.

In the year under review, QTC completed a broad range of financial advisory assignments to assist clients and the State in addressing financial risk management issues and delivering meaningful whole-of-State outcomes that contribute to the achievement of the Government’s fiscal priorities and objectives, including:

- the Logan Renewal Initiative for the Department of Housing and Public Works, to assist with the cost-effective delivery of social housing throughout south-east Queensland

- the development of new funding arrangements for the Department of Environment and Heritage Protection and the Department of Natural Resources and Mines to secure mine rehabilitation

- the development of a financial model to assist Queensland Treasury and Trade with the introduction of the National Disability Insurance Scheme

- the representation of the interests of the State’s energy sector through the provision of detailed submissions to the review of the National Energy Rules, to inform and influence the Australian Energy Regulator’s determination, the outcomes of which will result in a significant reduction in refinancing risk for the State, and

- the completion of 30 credit reviews of Government-owned corporations and local governments for Queensland Treasury and Trade and other shareholding departments to support their funding determinations.

In addition, QTC provided significant support for the Projects Queensland initiative within Queensland Treasury and Trade, with the secondment of 14 specialist staff. QTC employees within Projects Queensland are leading the evaluation and procurement of some of the State’s most important infrastructure and service delivery initiatives to achieve value-for-money outcomes, deliver projects within tight time frames, and enable an appropriate transfer of risk to the private sector.

QTC was also appointed to conduct the pre-work and preliminary due diligence activities for the Government’s proposed assets transactions initiative; the ‘Strong Choices Draft Plan’, which proposes to sell some assets, lease others and introduce an innovative option of private sector participation. While the Government will seek a mandate from Queensland voters at its next election before any divestment occurs, the completion of this work will help ensure that transactions are able to be completed in a timely manner, should the Government be given the mandate to proceed.

QTC’s role in equipping clients with specialist financial knowledge and capabilities was expanded during the year, with the development and implementation of a range of new financial education courses tailored to meet the strategic needs of clients and support the Government’s renewal and contestability initiatives.

In 2013-14, more than 700 employees from more than 50 of its client organisations participated in QTC’s targeted and tailored education program. QTC is now working with the Public Service Commission’s Commission of Audit (CoA) Implementation Team to develop and implement a financial skills training strategy for the Queensland Government workforce, as recommended by the CoA.

QTC’s mature, strong and well-understood risk management culture is supported by its firmly established enterprise-wide risk management program, and provides the foundation for all corporate activities.

In the year under review, QTC implemented an assurance framework for internal controls, identifying the organisation’s most important internal controls across all functions. The framework provides for periodic assurance from management—as well as independent assurance providers, such as internal audit—that each control is operating effectively.

Significant progress was also made towards the improvement of our tools and applications for managing market risk, credit risk and collateral for derivative transactions. This included initiatives to centralise market risk data to ensure data consistency across reports and improved visibility of business logic, which has further increased QTC’s capability to measure market risk.

QTC’s managed its portfolio market risk exposures, including interest rate, foreign exchange and counterparty risk, within Board-approved risk parameters. It also managed its financial markets risks in line with industry best practice and Basel Committee recommendations. In line with its internal and external policies, QTC continues to hold a portfolio of diverse, liquid financial securities to meet the State’s liquidity requirements.

In the year under review, significant priority was placed on the identification and implementation of opportunities to improve the efficiency and effectiveness of operations.

Planning is also underway for the longer-term strategy to ensure sustainability in our products, processes and systems, with a particular focus on the opportunities available in the changing technology environment. To support this, QTC restructured its information technology team to better enable it to respond to QTC’s corporate requirements, and established a division to ensure that all change initiatives align with QTC’s strategic and corporate direction and to provide support for the successful implementation of change projects.

The focus on entrenching a high-performance culture within the organisation continued, centred on activities to enhance the agility, capability, capacity and engagement of QTC’s workforce. With a KPI to ensure a positive trend, staff engagement rose to 60 per cent, an increase of eight percentage points on last year and three percentage points above target. The result was supported by leaders championing the organisational agenda and by all employees participating in action workshops to remove barriers and develop solutions.

A number of initiatives to support the achievement of a high performance culture were delivered, including:

- A Talent, Succession and Promotions framework was introduced with the objective of retaining, developing and most effectively deploying key talent. Succession planning focused on developing strong talent pipelines for key leadership and business-critical roles.

- A Leadership Development Program was delivered, enhancing leaders’ skills in conducting high-performance conversations and coaching. In parallel, accountability and responsibility was pushed down through the organisation through a review of HR policies, to enable greater delegation, and empowerment in decision making, for our leaders.

- A cross-organisation learning and development council was established to guide the delivery of technical and transferable skill training.

- QTC’s inaugural employee recognition program—the Chief Executive’s Awards—was launched.

- A new remuneration framework, along with updated position descriptions, was implemented to foster high performance. The new framework is more transparent, easier to understand and more effective in driving robust performance conversations.

- Strategic workforce planning was undertaken to forecast future demand for resourcing and capability mix across the business.

QTC continued its practice of regularly reviewing and updating its policies and procedures to comply with changes in the legislative and regulatory environment and to ensure employees have access to avenues through which to raise concerns, including an internal grievance process. QTC employees are employed under individual employment agreements, which adhere to the legislated provisions of theFair Work Act 2009.

| Workforce profile | FY 2013-14 |

|---|---|

| Full-time equivalent staff | 217 |

| Permanent retention rate | 85.96% |

| Permanent separation rate | 14.25% |

| Permanent average tenure | 6.67 years |

Corporate Governance

QTC is committed to maintaining high standards of corporate governance to support its strong market reputation and ensure that organisational goals are met and risks are monitored and appropriately addressed. QTC’s corporate governance practices are continually reviewed and updated in line with industry guidelines and standards.

QTC was established by the Queensland Treasury Corporation Act 1988 (the QTC Act) as a corporation sole (ie, a corporation that consists solely of a nominated office holder). The Under Treasurer of Queensland is QTC’s nominated office holder. QTC has delegated its powers to its two boards:

- the Queensland Treasury Corporation Capital Markets Board (the Board), which was established in 1991 and manages all of QTC’s operations except those relating to certain superannuation and other long-term assets, and

- the Long Term Asset Advisory Board, which was established in July 2008 and advises in relation to certain superannuation and other long-term assets that were transferred to QTC from Queensland Treasury on 1 July 2008.

QTC and the Capital Markets Board have agreed the terms and administrative arrangements for the exercise of the powers that have been delegated to the Board by QTC (as the corporation sole).

The Board operates in accordance with its charter, which sets out its commitment to various corporate governance principles and standards, the roles and responsibilities of the Board and its members (based on its delegated powers), and the conduct of meetings. The charter provides that the role and functions of the Board include:

- overseeing QTC’s operations, including its control and accountability systems

- developing and monitoring QTC’s strategic and corporate plans, operational policy and yearly budget

- monitoring and measuring financial and operational performance

- monitoring and measuring organisational and staff performance

- monitoring key risks and risk management processes, and

- ensuring that QTC’s compliance is appropriate for an organisation of its type.

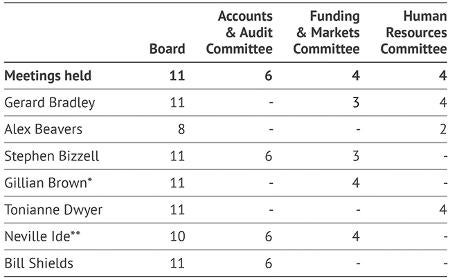

The Board holds monthly meetings (except in January) and may, whenever necessary, hold additional meetings.

Board appointments

The Board comprises directors who are appointed by the Governor-in-Council, pursuant to section 10(2) of the QTC Act, with consideration given to each Board member’s qualifications, experience, skills, strategic ability and commitment to contribute to QTC’s performance and achievement of its corporate objectives. QTC’s Board is entirely constituted of non-executive directors.

Conflict of interest

Board members are required to monitor and disclose any actual or potential conflicts of interest. Unless the Board determines otherwise, a conflicted Board member may not receive any Board papers, attend any meetings or take part in any decisions relating to declared interests.

Performance and remuneration

To ensure continuous improvement and to enhance overall effectiveness, the Board conducts an annual assessment of its performance as a whole. Board members’ remuneration is determined by the Governor in Council (details are disclosed in QTC’s financial statements).

Board committees

The Board has established three committees, each with its own terms of reference, to assist it in overseeing and governing various QTC activities.

Accounts and Audit Committee

The Accounts and Audit Committee has responsibility for the:

- adequacy and effectiveness of internal controls, including for the prevention of fraud

- integrity of financial statements

- adequacy and effectiveness of compliance monitoring, and

- audit effectiveness.

The Accounts and Audit Committee must have at least three members and meet at least four times a year.

During the year the Accounts and Audit Committee recommended the adoption of the half year and annual financial statements, reviewed external and internal audit reports and the progress in implementing the recommendations from those reports, and reviewed the Queensland Audit Office’s Client Service Plan and QTC’s Internal Audit Plan.

As required by the Audit Committee Guidelines: Improving Accountability and Performance issued by Queensland Treasury, QTC’s Accounts and Audit Committee has observed its terms of reference and has had due regard to the Audit Committee Guidelines.

Human Resources Committee

The Human Resources Committee has responsibility for:

- the appropriateness of any new or amended human resources policy

- the framework for, and review of, employee remuneration and performance, and

- employment terms and conditions.

The Human Resources Committee must have at least two members and meet at least four times a year. The Human Resources Committee has observed its terms of reference.

Funding and Markets Committee

In February 2014, the Funding & Markets Committee reviewed its Terms of Reference. The amendments reflect the refocus of the Committee away from an operational review of funding and pool performance towards a focus on assisting the Board to consider the performance and risk management of QTC’s funding and markets activities.

The core responsibilities of the Committee is to assist the Board by making recommendations about the policy to enhance the performance and management of risk in the areas of funding accessibility (including liquidity), and pool performance and to support QTC’s risk appetite with a focus on effectiveness and performance.

The Committee must have at least three members and meet at least four times a year. The Funding and Markets Committee has observed its terms of reference.

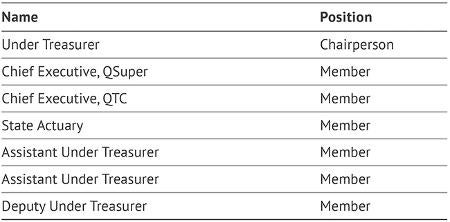

The Long Term Asset Advisory Board (LTAAB) was established in July 2008, following the transfer of certain superannuation and other long-term assets from Treasury to QTC (primarily for reasons relating to market volatility).

The LTAAB has power delegated from QTC to:

- manage the sufficiency of the funding of the long-term assets

- set investment objectives and strategies for the long-term assets

- set the appropriate investment structure for the long-term assets, and

- monitor investment performance of the long-term assets.

The LTAAB holds meetings at least four times per year and held five in the year under review.

The LTAAB members are appointed by the Governor in Council, pursuant to section 10(2) of the QTC Act.

The members of LTAAB are:

The LTAAB has observed its terms of reference.

In accordance with the provisions of the Auditor-General Act 2009, the Queensland Audit Office is the external auditor for QTC. The Queensland Audit Office has the responsibility for providing Queensland’s Parliament with assurances as to the adequacy of QTC’s discharge of its financial and administrative obligations.

QTC has an independent Internal Audit function that was outsourced to KPMG for the 2013-2014 financial year, and is outsourced to Ernst and Young for the 2014-2015 financial year. Internal Audit reports to the Accounts and Audit Committee. Internal audit is conducted under an Internal Audit Charter that is consistent with the relevant audit and ethical standards. The role of internal audit is to support QTC’s corporate governance framework by providing the Board (through the Accounts and Audit Committee) with:

- assurance that QTC has effective, efficient and economical internal controls in place to support the achievement of its objectives, including the management of risk, and

- advice with respect to QTC’s internal controls and business processes.

Internal Audit is responsible for:

- developing an annual audit plan, based on the assessment of financial and business risks (based on QTC’s approved significant risks and internal workshops) aligned with QTC’s strategic goals and objectives, and approved by the Accounts and Audit Committee

- providing regular audit reports and periodic program management reports to the management team and the Accounts and Audit Committee, and

- working constructively with QTC’s management team to challenge and improve established and proposed practices and to put forward ideas for process improvement.

In the year under review, KPMG completed its internal audits in accordance with the approved annual audit plan.

QTC has had due regard to Treasury’s Audit Committee guidelines, in establishing and supervising its outsourced internal audit function and, together with the Accounts and Audit Committee, in overseeing and monitoring the internal audit function.

In the 2013-14 financial year, the Queensland Audit Office (QAO) audited controls and conducted some substantive testing of QTC’s systems used to complete the half year and full year annual financial statements. The QAO raised five low-rated issues that have been considered by the Accounts and Audit Committee, and addressed.

QTC manages its risks within an enterprise-wide risk management framework (EwRM). The framework supports the achievement of QTC’s corporate strategies and objectives by providing assurance that QTC’s risks are being appropriately and effectively identified and managed, using a consistent and well-understood approach for evaluating and reporting risks.

As part of this framework, QTC periodically identifies its key or significant risks, which are reported to its Risk Management Team and to the Board through structured reporting processes.

QTC’s Chief Risk Officer is responsible for embedding QTC’s risk management policy and program in its business processes, to ensure a consistent organisation-wide approach to risk mitigation and an enhanced individual employee understanding of EwRM and what it means in their day-to-day work.

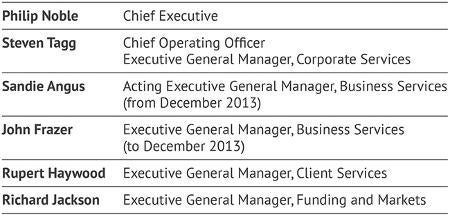

Our operating model links the strategy, culture, processes, people, leadership and systems of our organisation and outlines the key business processes we use to create value for our clients.

QTC’s organisational structure supports its operating model and achievement of the organisation’s strategies creating alignment throughout the organisation, linking appropriate staff expertise and accountabilities to the client value-creation process.

The responsibility for the day-to-day operation and administration of QTC is delegated by the Board to the Chief Executive and the Executive Management Team. The Chief Executive is appointed by the Board. Executives are appointed by the Chief Executive. As with the Board, all Executive Management Team appointments are made on the basis of qualifications, experience, skills, strategic ability, and commitment to contribute to QTC’s performance and achievement of its corporate objectives.

QTC’s Executive Management Team 2013-14

Gerard Bradley

BComm, Dip Adv Acc , FCA, FCPA, FAICD, FAIM

Chairman

Appointed 10 May 2012 with tenure to 30 June 2016

Board Committees

- Member, Human Resources Committee

- Member, Funding and Markets Committee

Prior to his appointment as QTC’s Chairman, Mr Bradley was the Under Treasurer and Under Secretary of the Queensland Treasury Department, a position he held from 1998 to 2012. He was also a QTC Board member from 2000-2007.

Mr Bradley has extensive experience in public sector finance gained in both the Queensland and South Australian treasury departments. He was Under Treasurer of the South Australian Department of Treasury and Finance from 1996 to 1998, and of Queensland’s Treasury Department from 1995 to 1996. Mr Bradley held various positions in Queensland Treasury from 1976 to 1995, with responsibility for the preparation and management of the State Budget and the fiscal and economic development of Queensland. He is currently a Director and Chairman of Queensland Treasury Holdings Pty Ltd and related companies, and a Director of Echo Entertainment Group Ltd.

Alexander Beavers

BComm, Dip Ec

Deputy Chairman

Appointed 1 September 2009 with tenure to 30 June 2015

Board Committees

- Member, Human Resources Committee

Alex Beavers was appointed Queensland’s Deputy Under Treasurer in June 2009. Prior to this appointment, he was Deputy Director-General, Policy, in the Department of the Premier and Cabinet, with responsibility for leading the Government’s policy coordination processes and managing policy advice preparation for the Premier.

Mr Beavers has also previously held the role of Assistant Under Treasurer with responsibility for Queensland’s fiscal strategy and taxation policy, as well as other senior roles within Queensland Treasury over the past 15 years.

Stephen Bizzell

BCom, MAICD

Appointed in February 2013 with tenure to 30 June 2015

Board Committees

- Member, Accounts and Audit Committee

- Member, Funding and Markets Committee

Stephen Bizzell is an experienced company director with skills in accounting, finance, risk management and commercial management. Mr Bizzell has more than 20 years’ corporate, finance and public company management experience in the resources, energy and financial services sectors with public companies in Australia and Canada. He was a co-founder and, for 12 years, executive director of coal seam gas company Arrow Energy Ltd and is Chairman of boutique corporate advisory and funds management group Bizzell Capital Partners Pty Ltd.

Mr Bizzell currently holds company directorships on a number of ASX listed boards including Armour Energy Ltd, Diversa Limited, Laneway Resources Ltd, Renascour Resources Ltd, Stanmore Coal Ltd, and Titan Energy Services Ltd.

Gillian Brown

LLB (Hons), Grad Dip Applied Finance and Investment, SIA

Appointed 1 July 2004; resigned 20 August 2014

Board Committees

- Chair, Funding and Markets Committee

Gillian Brown has more than 25 years’ experience as a specialist finance lawyer and has gained extensive corporate, financing and major project experience. She is a partner of Minter Ellison Lawyers in Queensland, heading the finance practice, and is a past Chairman of that firm. Ms Brown’s principal areas of practice include corporate finance, investment and financial services, financial markets, project and infrastructure finance, and property finance.

Ms Brown has advised government bodies on a number of project and transactional arrangements and has an in-depth knowledge of the mechanics of government and its objectives. Ms Brown is a director of the Australian Rail Track Corporation Limited.

Tonianne Dwyer

B Juris (Hons), B Laws (Hons), GAICD

Appointed 14 February 2013 with tenure to 30 June 2015

Board Committees

- Chair, Human Resources Committee

Tonianne Dwyer is a lawyer by profession with a career of more than 25 years in international investment and finance in both executive management and board positions.

She has held senior roles with Harnbros Bank Limited and Societe Generale and was an Executive Director of Quintain Estates & Development PLC.

Ms Dwyer’s executive experience covers a broad range of sectors, including real estate investment and development, financial services, health and aged care, education, research and development, and media, including a role with the finance division of the UK Department of Health. She has extensive experience of financing social infrastructure and of leading teams on public private partnership bids. Her operational experience includes UK, Europe and Wall Street.

Ms Dwyer currently holds directorships on DEXUS Property Group, DEXUS Wholesale Property Fund, Cardno Limited and Metcash Ltd and is appointed to the Senate of the University of Queensland.

Neville Ide

BBus, MCom, FCPA, FAICD

Appointed 1 July 2011; resigned 30 June 2014

Board Committees

- Member, Accounts and Audit Committee

- Member, Funding and Markets Committee

Neville Ide has more than 30 years’ experience in the financial services industry, predominantly banking and insurance; his most recent executive position was as Suncorp Metway Group’s Treasurer. He has extensive commercial experience in liquidity management, debt funding, capital management and balance sheet structuring.

From 2010, Mr Ide has served on a number of boards and provided financial risk management advisory services. He is also a non-executive director of RACQ Insurance Ltd, Queensland Motorways Pty Limited, Queensland Police Credit Union Ltd and Public Trust Office Investment Board.

Bill Shields

BEcon (Hons), MEc, MAICD

Appointed 1 July 2004 with tenure to 30 June 2015

Board Committees

- Chair Accounts and Audit Committee

Bill Shields has extensive experience in the banking and finance industry, as well as government policy advice, specialising in economics. His career responsibilities have included economic and financial market research in Australia and overseas, and the provision of analytical and strategic advice on the Australian financial system and monetary policy, Australia’s exchange rate arrangements and international financial developments, as well as oversight of energy markets in Australia, New Zealand and Singapore.

Mr Shields was previously Chief Economist and Executive Director of Macquarie Bank Limited (1987–2001), and he has also held positions with the Reserve Bank of Australia (1983–1985), the International Monetary Fund (1973–75 and 1977–83), and the Australian Treasury. He was a Visiting Professor at the Macquarie Graduate School of Management of Macquarie University from 2001-09 and has recently taught at the Australian Catholic University in Brisbane. He is currently a director of the Sydney Anglican Schools Corporation and is Chair of its Education and Strategic Development Committee.

Investor Report

QTC has an intrinsic link with the State of Queensland, as all of its obligations with regard to debt securities and derivatives are unconditionally guaranteed by the Treasurer of Queensland on behalf of the State Government.

Since 1988, QTC has funded the Queensland Government’s public sector capital works programs and remains an important part of Queensland’s economic growth story. QTC continues to maintain a high-quality asset portfolio of public sector loans and investments, with a loan portfolio covering 174 Government clients — all underpinned by Queensland’s AA+/Aa1 credit rating.

In December 2013, QTC revised its original $12.1 billion 2013-14 estimated borrowing program down to $11.1 billion as a result of better operating performance in the general government sector, lower borrowing requirements across government and the deployment of surplus liquidity. The target borrowing program was achieved by 30 June 2014, with funds borrowed from global markets used to refinance maturing debt, as well as meet the new funding requirements of QTC’s clients—Queensland Government public sector entities—for their additional capital expenditure requirements.

In the Australian fixed income sector, QTC outperformed its peers with a significant narrowing of bond spreads over the year. On average, spreads contracted by 0.40 percentage points compared to Australian Government bonds and 0.30 percentage points to the benchmark swap rate.

To lengthen QTC’s debt maturity profile, and provide investors with a maturity in each calendar year out to 2025, QTC issued $1 billion of a new AUD denominated benchmark bond maturing in July 2025. A further $1 billion was tapped via syndication a month following the primary issuance. Investors viewed both of these public issues favourably, evidenced by the diversity of investor type and geographic distribution. Having US Rule 144A capability imbedded into QTC’s AUD domestic benchmark bond program continues to see an increased participation from the US market in primary market issuances.

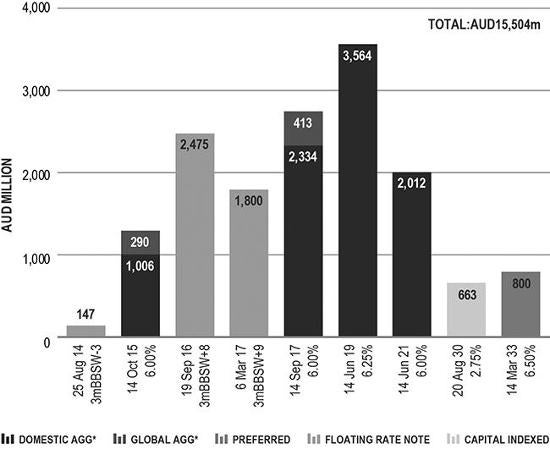

While AUD benchmark bonds remain the cornerstone of QTC’s funding program, QTC also issued two benchmark-sized floating rate notes maturing in 2016 and 2017 respectively in response to investor demand for floating rate note instruments at the shorter end of the curve. These were the first floating rate instruments QTC had issued since 2011, and by year-end, aggregate outstandings were valued at more than $4 billion.

To complement its term debt issuance, QTC also maintained approximately $5 billion of commercial paper outstandings throughout the year under its Domestic Treasury-Note and US and Euro Commercial Paper programs.

In August, more than $4 billion of QTC term debt matured in both the benchmark bond program and QTC’s Australian Government Guaranteed bonds.

QTC’s Fixed Income Distribution Group (FIDG) comprising fourteen global and domestic banks act as QTC’s intermediaries in debt capital markets by supporting secondary market activity, as well as primary market issuance. As in previous years, QTC continued to work closely with its FIDG members to broaden its global investor base to support liquidity across its benchmark lines. Turnover of benchmark bonds during the year increased from the previous period.

QTC values its diverse, global investor base, estimating that almost half of its investors are domiciled in offshore jurisdictions. To help market participants stay up-to-date with QTC’s funding activities, investors can now subscribe to receive quarterly funding updates, market announcements for all public issues, as well as relevant market information about Queensland and QTC.

In 2013-14, Queensland/QTC maintained its Aa1/P1/Negative and AA+/A-1+/Stable credit ratings from Moody’s Investors’ Service and Standard & Poor’s respectively. In June 2014, both rating agencies affirmed their ratings following the 2014-15 Queensland State Budget release.

QTC’s credit ratings (as at 30 June 2014)

| Long-term | Short-term | Outlook | |

| Local currency | |||

| Moody’s | Aa1 | P1 | Negative |

| Standard & Poor’s | AA+ | A-1+ | Stable |

| Foreign currency | |||

| Moody’s | Aa1 | P1 | Negative |

| Standard & Poor’s | AA+ | A-1+ | Stable |

| Australian Government guaranteed | |||

| Moody’s | Aaa | N/A | Stable |

| Standard & Poor’s | AAA | N/A | Stable |

AUD benchmark bonds

QTC continued to build its AUD yield curve during the year by issuing a new benchmark bond with US Rule 144A capability maturing in 2025.

| Bond | Maturity | Coupon | Date issued | Amount issued at launch (AUD) |

| Q2025 | 21 July 2025 | 4.75% | 2 April 2014 | $1.0 billion |

QTC issued two benchmark-sized floating rate notes maturing in 2016 and 2017.

| FRN | Maturity | BBSW + margin | Date issued | Amount issued at launch (AUD) |

| 2016 | 19 September 2016 | 3mBBSW+ 8bp | 19 September 2013 | $1.2 billion |

| 2017 | 06 March 2017 | 3mBBSW+ 9bp | 6 March 2014 | $1.0 billion |

In 2009 QTC accepted the offer of a guarantee from the Australian Government (in addition to the guarantee provided by the Queensland Government) as a result of the global economic and financial crisis. All remaining benchmark bond lines under this guarantee will remain covered until maturity or retirement. These bonds are rated Aaa/AAA by Moody’s Investors Service and Standard & Poor’s respectively. The Guarantee was closed to new issuance after 31 December 2010.

Through its Fixed Income Distribution Group, QTC offers investors the opportunity to switch Australian Government Guaranteed AUD bonds into equivalent AUD benchmark bonds. During the year, investors chose to switch $5 billion into QTC’s AUD benchmark bonds.

- QTC is the largest sub-sovereign Australian fixed income issuer.

- QTC’s AUD benchmark bonds are its principal source of funding.

- QTC provides investors with a choice of 12 benchmark bonds, ranging in maturity from 2014 to 2025.

- QTC works closely with its Fixed Income Distribution Group to actively support secondary market activity in its bonds.

- Issuance is executed on a tap, tender, reverse enquiry, and/or syndication basis, depending on market conditions.

Following the release of Queensland’s 2014-15 State Budget on 3 June 2014, QTC announced its estimated 2014-15 borrowing program to be $13 billion: $8 billion term debt and approximately $5 billion of short-term debt (primarily commercial paper).

QTC expects to fund its term debt issuance by supporting liquidity in its benchmark bonds, which will continue to remain QTC’s principal source of funding. QTC will consider further issuance of floating rate notes, and issuance will be targeted to smooth the benchmark bond maturity profile.

Investors will again be offered the opportunity to switch Australian Government Guaranteed bonds into QTC’s AUD benchmark bonds guaranteed by the State of Queensland.

As part of the Queensland State Budget release, the Government announced a ‘Strong Choices Draft Plan’ of asset transactions – including sale, long-term leases and private sector participation.

The final plan is expected to be announced in September 2014 and the Government has indicated that this plan will form part of its policy agenda for the next State Government election expected in early 2015. The Government has made it clear that no assets will be sold or leased prior to a mandate being obtained at the election.

As a result, QTC’s 2014-15 borrowing program does not take into account any proceeds from potential asset transactions. QTC will continue to keep the market informed on any outcomes relating to the proposed asset transactions and impact on its funding requirements.

QTC’s 2014-15 term debt indicative borrowing program

| AUD M* | |

| New money | |

| State (includes General Government and Government owned corporations) | 3,800 |

| Local Government and other entities# | 900 |

| Total new money | 4,700 |

| Net term debt refinancing | 3,300 |

| Total term debt requirement | 8,000 |

Overview of funding facilities as at 30 June 2014

| Facility | Size ($M) | Maturities | Currencies | On issue (AUD M) | |

| Short-term | Domestic T-Note | Unlimited | 7–365 days | AUD | 2,164 |

| Euro CP | USD10,000 | 1–364 days | Multi-currency | 1,573 | |

| US CP | USD10,000 | 1–270 days | USD | 752 | |

| Long-term | AUD Bond | Unlimited | 12 benchmark lines: 2014–2025 | AUD | 64,928 |

| 4 AGG* lines: 2015–2021 | AUD | 8,916 | |||

| Preferred line: 2033 | AUD | 800 | |||

| Capital Indexed Bond: 2030 | AUD | 834 | |||

| 3 floating rate notes: 2014, 2016, 2017 | AUD | 4,422 | |||

| Global AUD Bond | AUD20,000 | 2 AGG* lines 2015 &2017 (transferrable to domestic bonds) | AUD | 703 | |

| Multi-currency Euro MTN | USD10,000 | Any maturity subject to market regulations | Multi-currency | 1,101 | |

| Multi-currency US MTN | USD10,000 | 9 months – 30 years | Multi-currency | 0 | |

| Conservative: | Balanced debt maturity profile supported by liquid reserves |

| Prudent: | Disciplined approach to financial risk management |

| Transparent: | Comprehensive, regular market updates |

| Committed: | Valued long-term investor and intermediary relationships |

Australia is one of only eight countries globally rated AAA/Aaa/AAA with a stable outlook from all three major credit ratings agencies.

The Australian Government provides explicit financial support to all Australian states and territories in the form of:

- the payment of grants under the principle of the Horizontal Fiscal Equalisation scheme, which seeks to reduce the revenue-raising and cost disparities between the Australian states and territories

- National Disaster Relief and Recovery Arrangements, which provides reimbursement for eligible costs for natural disasters, and

- the offer of a time-limited, voluntary guarantee over Australian state and territory borrowings from July 2009 to December 2010.

Core to its key funding principles, QTC is committed to being open and transparent with investors and its partners in the financial markets.

Through its website, QTC provides a range of information for investors on its various funding facilities and annual borrowing program. The website also hosts an analysts’ centre with information and links about Australia and Queensland to help investors gain a better understanding of:

- the different levels of government in Australia

- the forms of fiscal support the Australian Government provides to the states and territories

- relevant governance practices, legislation and polices

- financial data and budget information, and

- economic and trade data.

A digital version of QTC’s investor booklet is available for iPad users from the iTunes store.

QTC also offers investors the ability to subscribe to quarterly funding updates in English, Japanese, as well as Modern Chinese and Traditional Chinese.

Website: Click here

Quarterly investor updates: Subscribe from the institutional investor section of the website

Analysts’ centre: Click here

Invest in QTC for iPad users: Click here

Bloomberg ticker: qtc

Note: Investors with a US-based iTunes account do not have access to the Invest in QTC iPad application.

Dedicated distribution group

QTC has dedicated dealer panels to ensure investors have choice and reliable access to trade in QTC’s debt securities.

QTC’s Fixed Income Distribution Group is committed to providing investors with two-way bond pricing in the secondary market, as well as supporting primary issuance activities.

QTC’s Fixed Income Distribution Group* comprises:

- ANZ Banking Group Limited

- Bank of America Merrill Lynch

- Barclays (withdrew 30 June 2014)

- BNP Paribas

- Citi

- Commonwealth Bank of Australia

- Deutsche Bank

- HSBC

- JP Morgan

- National Australia Bank Limited

- Nomura International plc

- RBC Capital Markets

- TD Securities

- UBS Investment Bank

- Westpac Banking Corporation

*Actual dealer entities may vary depending on the facility and location of the dealer. See Appendix D for contact details.

Financial statements

QTC’s Financial Statements for the 2013-14 Financial Year (Download pdf, 704.58 Kb)

Appendicies

Appendix A: Loans to Clients (Download pdf, 141.71 Kb)

QTC is required to make various disclosures in its Annual Report. QTC is also required to make various disclosures on the Queensland Government’s Open Data website (qld.gov.au/data) in lieu of inclusion in its Annual Report. This Appendix sets out those mandatory disclosure statements that are not included elsewhere in the report or made available on the Open Data website.

Information systems and record keeping

During the year, QTC continued its compliance with the provisions of the Public Records Act 2002, and its implementation of theInformation Standard 40: Recordkeeping and Information Standard 31: Retention and Disposal of Public Records.

QTC has continued its work with State Archives on the development of a QTC-specific Local Retention and Disposal Schedule, and provides training to staff in the appropriate management of public records in all formats, including email.

During the year, QTC’s record keeping systems and capabilities largely continued unchanged. QTC is investigating the procurement and implementation of an electronic document management system for implementation in the 2014-15 year.

Public Sector Ethics Act

QTC provides the following information pursuant to obligations under section 23 of the Public Sector Ethics Act 1994 (Qld) to report on action taken to comply with certain sections of the Act.

QTC employees are required to comply with QTC’s Code of Conduct for employees, which aligns with the ethics principles and values in the Public Sector Ethics Act 1994, as well as the Code of Ethics and Code of Conduct established by the Australian Financial Markets Association of which QTC is a member. Both codes are available to employees via QTC’s intranet. Copies of these codes can be inspected by contacting QTC’s Human Resources Group (see Appendix D for contact details). Appropriate education and training about the code of conduct has been provided to QTC staff.

QTC’s corporate governance policies and practices ensure that QTC:

- acts ethically, within appropriate law, policy and convention, and

- addresses the systems and processes necessary for the proper direction and management of its business and affairs.

QTC is committed to:

- observing high standards of integrity and fair-dealing in the conduct of its business, and

- acting with due care, diligence and skill.

QTC’s Compliance Policy requires that QTC and all employees comply with the letter and the spirit of all relevant laws and regulations, industry standards, and relevant government policies, as well as QTC’s own policies and procedures.

Remuneration: Board and Committee

For the year ending 30 June 2014, the remuneration and committee fees of the QTC Capital Market Board members (excluding superannuation contributions and non-monetary benefits) were as follows:

| Board | Committee | ||

| Chairperson | $100,527 | Chairperson | $6,658 |

| Member | $33,551 | Member | $5,152 |

The total remuneration payments made to the members of the QTC Capital Market Board was $391,233 and the total on-costs (including travel, accommodation, and hiring of motor vehicles for the members) was $45,961.

No payments in relation to remuneration or on-costs (including travel, accommodation, and hiring of motor vehicles for the members) were made to members of the Long Term Asset Advisory Board in the year ending 30 June 2014.

Related entities

The related entities in Note 30 (except Sunshine Locos Pty Ltd) are consolidated into Queensland Treasury’s financial report.

Australian Government Guarantee (AGG): Also known as the Commonwealth Government Guarantee. In response to the global financial crisis, on 25 March 2009, the Australian Government provided a time-limited, voluntary guarantee over existing and new Australian state and territory government borrowing. On 16 June 2009, the Queensland Government took up the guarantee on all existing QTC AUD denominated benchmark bond lines (global and domestic) with a maturity date of between 12 months and 180 months (1-15 years). The RBA approved QTC’s application on 11 December 2009. The AGG was withdrawn for new borrowings after 31 December 2010.

Basis point: One hundredth of one per cent (0.01%).

Bond: A financial instrument where the borrower agrees to pay the investor a rate of interest for a fixed period of time. A typical bond will involve regular interest payments and a return of principal at maturity.

Commonwealth Government Guarantee (CGG): See Australian Government Guarantee above.

CP (commercial paper): A short-term money market instrument issued at a discount with the full face value repaid at maturity. CP can be issued in various currencies with a term to maturity of less than one year.

Credit rating: Measures a borrower’s creditworthiness and provides an international framework for comparing the credit quality of issuers and rated debt securities. Rating agencies allocate three kinds of ratings: issuer credit ratings, long-term debt and short-term debt. Issuer credit ratings are among the most widely watched. They measure the creditworthiness of the borrower including its capacity and willingness to meet financial obligations. QTC has a b rating from two rating agencies—Standard & Poor’s, and Moody’s.

Distribution group: A group of financial intermediaries who market and make prices in QTC’s debt instruments.

GOC: Government-owned corporation.

Issue price: The price at which a new security is issued in the primary market.

Liquid: Markets or instruments are described as being liquid, and having depth, if there are enough buyers and sellers to absorb sudden shifts in supply and demand without price distortions.

Market value: The price at which an instrument can be purchased or sold in the current market.

MTN (Medium-Term Note): A financial debt instrument that can be structured to meet an investor’s requirements in regards to interest rate basis, currency and maturity. MTNs usually have maturities between 9 months and 30 years.

QTC: Queensland Treasury Corporation.

RBA: Reserve Bank of Australia.

T-Note (Treasury Note): A short-term money market instrument issued at a discount with the full face value repaid at maturity. T-Notes are issued in Australian dollars with a term to maturity of less than 1 year.

Queensland Treasury Corporation

Level 6, 123 Albert Street

Brisbane Queensland Australia

GPO Box 1096

Brisbane Queensland Australia 4001

Telephone: +61 7 3842 4600

Facsimile: +61 7 3221 4122

Email: enquiry@qtc.com.au

Internet: www.qtc.com.au

Queensland Treasury Corporation’s annual and half-yearly reports (ISSN 1837-1256 print; ISSN 1837-1264 online) are available on QTC’s website. If you would like a copy of a report posted to you, please call QTC’s Corporate Affairs group on +61 7 3842 4685.

If you would like to comment on a report, please complete the online enquiry form located on our website.

| Telephone | |

| Reception | +61 7 3842 4600 |

| Executive Office | +61 7 3842 4611 |

| Business Services | +61 7 3842 4872 |

| Client Services | +61 7 3842 4901 |

| Corporate Services | +61 7 3842 4833 |

| Funding & Markets | +61 7 3842 4647 |

| Strategic Alignment & Implementation | +61 7 3842 4736 |

| Stock Registry (Link Market Services Ltd) | 1800 777 166 |

Download QTC’s dealer panels contact list (as at 30 June 2014) (PDF).

Download QTC’s issuing and paying agents contact list (PDF).

![]()

QTC is committed to providing accessible services to Queensland residents from culturally and linguistically diverse backgrounds.

If you have difficulty understanding this report, please contact QTC’s Corporate Affairs group on +61 7 3842 4685 and we will arrange for an interpreter to assist you.

Open Data

In accordance with the Annual report requirements for Queensland Government agencies: Requirements for the 2013-2014 reporting period, with which we have to comply under the Financial and Performance Management Standard 2009, QTC publishes details of its annual expenditure on consultants and overseas travel.

Availability of annual reports

QTC’s annual and half-yearly reports (ISSN 1837-1256) are available on QTC’s website for the past five financial years, earlier years are available by request. Printed copies can also be provided; please contact us for further information.

Compliance checklist

The compliance checklist outlines the governance, performance, reporting and other specific requirements for annual reports in accordance with the Annual report requirements for Queensland Government agencies: Requirements for the 2013-2014 reporting period.

Feedback

We are committed to continually improving our Annual Report. Your feedback on QTC’s Annual Report, including presentation, ease of navigation, value of information, style of language, level of detail and suggestions for improvement, can be provided via our online enquiry form.

Disclaimer

The materials presented on this site are provided by the Queensland Treasury Corporation for information purposes only. Users should note that the electronic versions of the Annual Report on this site are not recognised as the official or authorised version. The official copy of the Annual Report, as tabled in the Legislative Assembly of Queensland, can be accessed from the Queensland Parliament tabled papers website database.